Political Economy in Finance

This post reports on recent work presented at the first edition of the CEPR Conference Series on the Political Economy of Finance, which focused on the politics of regulation and central banking. The conference, held on February 12, 2021 and co-sponsored by three Dutch universities (Erasmus University Rotterdam, Tilburg University, University of Amsterdam), kickstarted the PolEconFin initiative (www.poleconfin.org). The PolEconFin initiative comprises of a conference series and an online platform, which gives researchers an opportunity to share their work with a community interested in research on the political economy of finance.

Exploring political economy topics in finance research is still relatively new. The political economy of finance studies how the design of political institutions and the distribution of political power in society affect the development and functioning of financial systems, and vice versa (see Pagano and Volpin, 2001; Perotti, 2014; Lambert and Volpin, 2018, for surveys). Early research focused on topics such as political connections in firms (Fismann, 2001; Khwaja and Mian, 2005; Faccio, 2006) or politically-motivated changes in financial regulation and development (Kroszner and Strahan, 1999; Biais and Perotti, 2002; Bolton and Rosenthal, 2002; Pagano and Volpin, 2005; Perotti and von Thadden, 2006). While these contributions appeared mostly in economic journals, finance journals also started opening up to this research area in the most recent years.

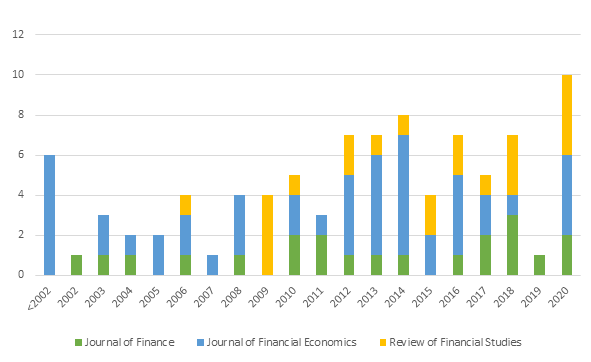

Figure 1 shows the number of articles published in the top-3 finance journals (Journal of Finance, Journal of Financial Economics, Review of Financial Studies) that study questions related to the political economy of finance. Only a handful of articles were published in the mid-2000s, but interest rose following the financial crisis. The overwhelming majority of these publications is empirical work. Taking stock of research in this area reveals increasing awareness of the importance of political economy issues in finance but also reflects that the area is far from saturated.

The goal of PolEconFin is to connect researchers in this growing area and promote their work, and the first edition of the conference series was a successful start of this initiative.

Electoral politics, credit, and regulation

The electoral consequences of financial crises are well-documented. Yet the specific mechanisms through which financial crises affect elections remain elusive. Sartre et al. (2020) and Müller (2020) focus on some mechanisms.

The paper of Sartre et al. (2020) helps understand how public finance mismanagement fuels the rise of populism during financial crises. Between 1996 and 2011, more than 1,500 French municipalities contracted high-risk structured loans with the bank Dexia. In September 2011, the newspaper Libération leaked a confidential file from Dexia, detailing all toxic loans it granted to municipalities. For the municipal elections following the leak, Sartre et al. (2020) find that affected municipalities saw a rise in populist voting and an increased entry of both far-right and far-left populist politicians. Far-right benefited more in areas with more fragile economic conditions and higher growth of immigrant population.

Müller (2020) investigates how the design of policies contributes to politicians’ reelection prospects. He shows that macroprudential policies, supposed to curtail the risks of future financial crises, were systematically loosened in the run-up to 221 general elections across 58 countries. Politicians seem to do so because they do not want to cut off voters from access to credit.

Institutions, reforms, and politics

Policy reforms result from the complex interaction between various interest groups. In his keynote lecture (available here), Francesco Trebbi (Berkeley Haas) depicts the opaque and convoluted channels through which interest groups “invest in influence” and ultimately affect economic and policy outcomes. In particular, he highlights the important, albeit under-studied, role of localized charitable giving as a means of contributing to politicians (Bertrand et al., 2020a), donations to non-profits in exchange for regulatory advocacy (Bertrand et al., 2018a, 2018b), and firm acquisition as a tool to amplify political contributions of investors (Bertrand et al., 2020b).

The success (or failure) of interest groups in shaping policy reforms also depends on various features of political institutions. Foarta and Morelli (2020) study a problem of a regulator who receives imprecise information about the regulatory problem at hand. They find that overly complex reforms are implemented when regulators perceive the problem as complicated and are highly uncertain about the incentives of interest groups initiating reform proposals. However, the complexity of today’s reforms increases the difficulty of understanding future problems. In this context, Foarta and Morelli (2020) also show that variation in the starting institutional conditions may lead to drastically different regulatory paths: complexity traps, cycles of complexification-simplification or regulatory gridlock.

Perotti and Soons (2019) study the political economy of the euro monetary area, seen as an arrangement among institutionally diverse economies. In their setup, politicians in institutionally weak countries need to spend more to remain in power, so in some states they may have to devalue the currency to avoid a default. They find that a diverse monetary union implies an implicit fiscal transfer to strong countries due to devaluation, while fiscal capacity in weaker countries is reduced just as borrowing constraints are relaxed. A credible monetary union may require fiscal transfers from strong countries during crises, yet it can be mutually beneficial. Fiscal transfers thus represent a structural feature rather than a design flaw in a diverse monetary union (see Perotti and Soons, 2020, for a non-technical summary).

Governance and central banking

After the financial crisis, central banks around the world saw their responsibilities further extended to financial stability domains (Masciandaro and Romelli, 2015). Distributional choices are thus increasingly left in the hands of “unelected” central bankers (Tucker, 2019). Goncharov et al. (2020) and Fabo et al. (2021) uncover new stylized facts about central banks, which further challenge their political independence and accountability.

Goncharov et al. (2020) document the presence of a discontinuity in the distribution of central bank profits. Based on a sample consisting of 155 central banks over 23 years, they observe that central banks are more likely to report (small) profits than losses. Measures of political and market pressures as well as central bankers’ career concerns significantly predict small profits versus losses. Small positive profits are also associated with more lenient monetary policy and higher inflation. Together, these results suggest that central banks are concerned about the sign of their profits, probably for political reasons.

Fabo et al. (2021) compare research on the macroeconomic effects of quantitative easing (QE) produced by central bank economists and academic economists (see Kempf and Pastor, 2020, for a summary). Central bank studies report QE effects on output and inflation that are stronger and use more positive language in their studies compared to those written by academics. Moreover, central bankers whose studies report more significant effects of QE have better career outcomes. Fabo et al. (2021) also conduct a survey showing substantial involvement of bank management in research production and public distribution. However, the extent to which this involvement affects research outcomes remains a question open for future research.

PolEconFin: a platform for researchers

The 2021 edition of the CEPR Conference Series on the Political Economy of Finance only featured a few key advances but shows how fruitful and innovative the area is. It also stressed the importance of putting political economy at the center of finance research. As pointed out by Francesco Trebbi in his keynote lecture, the political economy of finance is about the reinforcing feedback loop between financial power, political power and government policy, whose byproducts are top income inequality, stifled innovation and competition, sluggish productivity growth, and political pushback.

However, researchers active in political economy of finance tend to be dispersed in more strict disciplinary areas, such as macroeconomics, public economics, economic history, law, or financial economics. Only a few other conferences are currently dedicated to research in this area, such as the London Political Finance Workshop (Beck et al. 2020). The PolEconFin platformseeks to provide an all-year-round meeting point for theorists and empiricists with shared interests in this topical area and build a research community with a focus on public policy.

Interested in the initiative? Please connect via www.poleconfin.org and share your work and expertise with other researchers.

References

Beck, Thorsten, Orkun Saka and Paolo Volpin, 2020, Finance and politics: New insights, VoxEU.org, 10 July.

Bertrand, Marianne, Matilde Bombardini, Raymond Fisman, and Francesco Trebbi, 2018a, Tax-exempt lobbying: Corporate philanthropy as a tool for political influence, VoxEU.org, 3 September.

Bertrand, Marianne, Matilde Bombardini, Raymond Fisman, Bradley Hackinen, and Francesco Trebbi, 2018b, Hall of mirrors: Corporate philanthropy and strategic advocacy, NBER Working Paper No.25329.

Bertrand, Marianne, Matilde Bombardini, Raymond Fisman, and Francesco Trebbi, 2020a, Tax-exempt lobbying: Corporate philanthropy as a tool for political influence, American Economic Review 110, 2065-2102.

Bertrand, Marianne, Matilde Bombardini, Raymond Fisman, Francesco Trebbi, and Eyub Yegen, 2020b, Investing in influence: Investors, portfolio firms, and political giving, Working Paper.

Biais, Bruno, and Enrico Perotti, 2002, Machiavellian privatization, American Economic Review 92, 240-258.

Bolton, Patrick, and Howard Rosenthal, 2002, Political intervention in debt contracts, Journal of Political Economy 110, 1103-1134.

Fabo, Brian, Martina Jančoková, Elisabeth Kempf, and Ľuboš Pástor, 2021, Fifty shades of QE: Comparing findings of central bankers and academics, Journal of Monetary Economics, forthcoming.

Faccio, Mara, 2006, Politically connected firms, American Economic Review 96, 369-386.

Fisman, Raymond, 2001, Estimating the value of political connections, American Economic Review 91, 1095-1102.

Foarta, Dana, and Massimo Morelli, 2020, Complexity and the reform process, Working Paper.

Goncharov, Igor, Vasso Ioannidou, and Martin Schmalz, 2020, (Why) do central banks care about their profits? Working Paper.

Kempf, Elisabeth and Lubos Pastor, 2020, Fifty shades of QE: Central banks versus academics, VoxEU.org, 5 October.

Khwaja, Asim, and Atif Mian, 2005, Do lenders favor politically connected firms? Rent provision in an emerging financial market, Quarterly Journal of Economics 120, 1371-1411.

Kroszner, Randall, and Philip Strahan, 1999, What drives deregulation? Economics and politics of the relaxation of bank branching restrictions, Quarterly Journal of Economics 114, 1437-1467.

Lambert, Thomas, and Paolo Volpin, 2018, Endogenous political institutions and financial development, in Thorsten Beck and Ross Levine, eds.: Handbook of Finance and Development (Edward Elgar, London).

Masciandaro, Donato, Davide Romelli, 2015, Central bank independence before and after the Great Recession, VoxEU.org, 28 August.

Müller, Karsten, 2020, Electoral cycles in macroprudential regulation, Working Paper.

Pagano, Marco, and Paolo Volpin, 2001, The political economy of finance, Oxford Review of Economic Policy 17, 502-519.

Pagano, Marco, and Paolo Volpin, 2005, The political economy of corporate governance, American Economic Review 95, 1005-1030.

Perotti, Enrico, 2014, The political economy of finance, Capitalism and Society 9, Article 1.

Perotti, Enrico, and Oscar Soons, 2019, The political economy of a diverse monetary union, CEPR Discussion Paper No. 13987.

Perotti, Enrico and Oscar Soons, 2020, The euro: A transfer union from a start, VoxEU.org, 18 February.

Perotti, Enrico, and Ernst-Ludwig von Thadden, 2006, The political economy of corporate control and labor rents, Journal of Political Economy 114, 145-174.

Sartre, Emilie, Gianmarco Daniele, and Paul Vertier, 2020, Toxic loans and the rise of populist candidacies, Working Paper.

Tucker, Paul, 2019, Unelected Power (Princeton University Press, Princeton).

This post is co-written with Enrico Perotti and Magdalena Rola-Janicka and also published in VoxEU.